Tax Exempt Purchases

Is My Purchase Tax Exempt?

Unlike many other states, Washington does not offer a state sales tax exemption to its state agencies and institutions. Most purchases for goods and services made by the University are taxed at the state and local levels. The state does conduct periodic audits and reviews all tax payments submitted by the University, so it is significantly critical we ensure our purchases are appropriately taxed. Fortunately, using the University Marketplace helps ensure adherence to this important requirement.

However, under some very specific circumstances, some University purchases may be considered sales tax-exempt. Generally, tax-exempt purchases are those directly related to research. The following link is to the state’s RCW regarding this exemption. If all conditions are met within this RCW, a purchase may be considered tax-exempt. Note – Western has limited any-tax exempt purchases to those greater than $3,000. Purchases in total less than that amount will be processed with tax.

If you require a Tax Exemption for your purchase, please fill out the Tax Exempt eSign Form.

Please reference this Tax Exempt Form # on all Marketplace Order, Purchase Orders, or Payment Forms.

The Tax Exemption Process

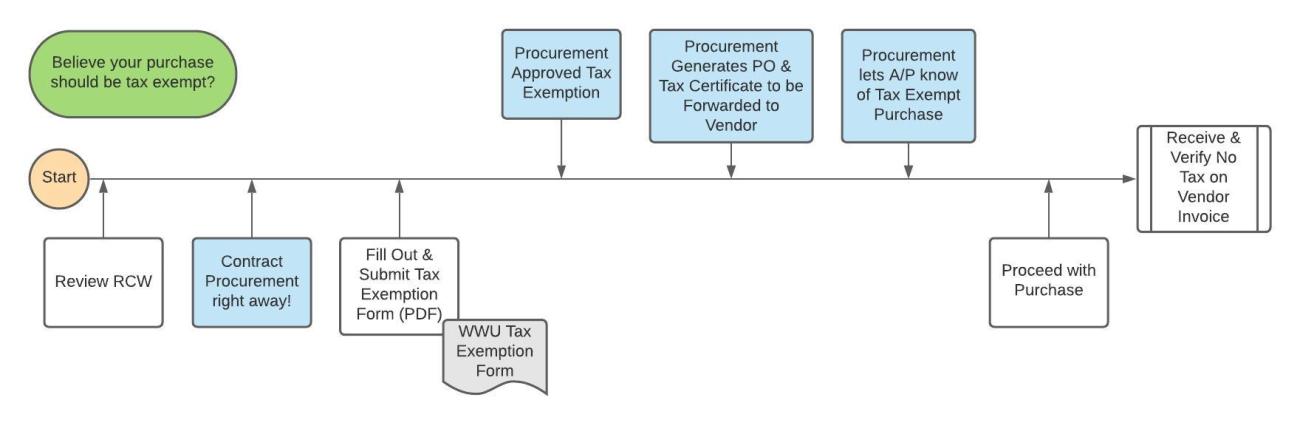

If a department believes a purchase is tax exempt, it must follow these steps:

- Contact the Procurement office well in advance of any “need” date for the item. Potential tax-exempt purchases must also comply with Western’s purchasing rules and competitive practices may apply.

- Review the aforementioned RCW and, if determined the tax-exempt option is applicable, alert the Procurement personnel prior to processing PO’s or contracts.

- To submit a request for a tax-exempt purchase, departments must complete and have approved the following certification for each transaction.

- The completed certification must be submitted to Procurement prior to or with any purchase requisition or contract request.

- Upon receipt of a purchase requisition form, Procurement will generate a PO without the sales tax included and forward a tax-exempt certificate, along with the PO, to the vendor.

- Procurement will notify Accounts Payable of the tax-exempt purchase and will file the certification for future audit review

- Receive goods as normal and verify, once received, the vendors invoice does not include sales tax.

If you have any questions regarding tax exempt purchases in the meantime please reach out to us as Purchasing.Department@wwu.edu.