Mileage & Ground Transportation

Travelers are required to complete the Basic Driver Safety Course before driving any vehicle for official university business.

- Washington State rule 10.10.10.a1 mandates travelers choose the most economical means of travel

- Western encourages travelers to use university vehicles and carpool whenever possible

- When these options are unavailable, compare the cost of mileage vs rental vehicle and train/bus/etc. to find the most cost-efficient option

Using Your Personal Car for Business Travel

- If you drive your own car on University business, you are reimbursed the applicable rate for each mile driven.

- You are responsible for your own car insurance. If you are in an accident, your insurance is the primary coverage.

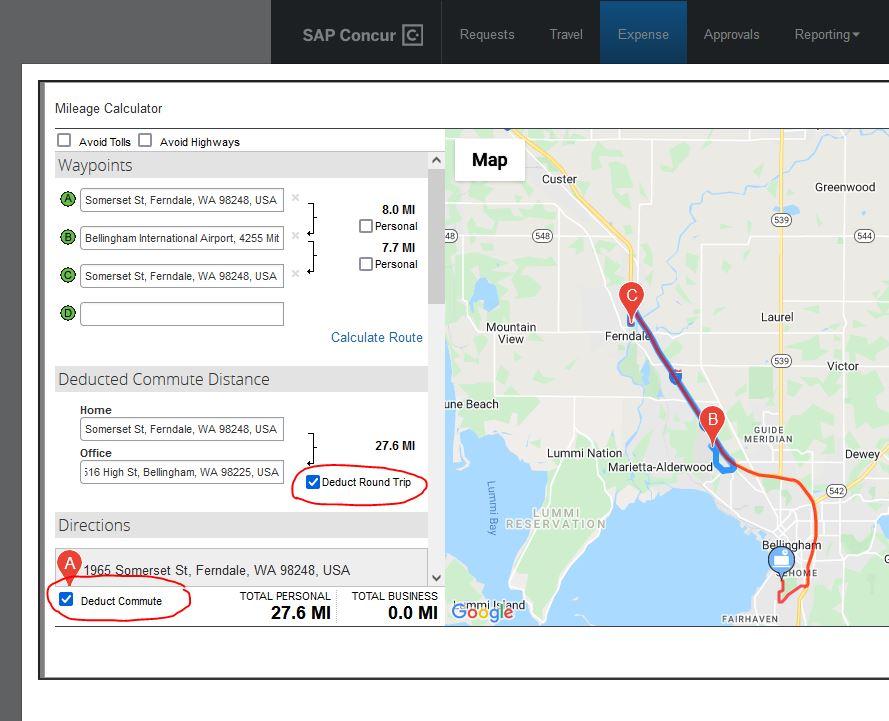

- Concur Expense provides a mileage calculator with Google Maps and allows travelers to deduct their commute:

Deduct your Commute in Concur

Inside the Mileage Calculator, check the options for Deduct Round Trip and Deduct Commute

Mileage Rate

As of Jauary. 1, 2024 the Personal Car Mileage Rate is $0.67 per mile

Past Rates

- Jan. 1 - Dec. 31, 2023: $0.655/mile

- July 1, 2022 - Dec. 31, 2022: $0.625/mile

- Jan. 1 2022 - June 30 2022: $0.585/mile

- Jan. 1 - Dec. 31, 2021: $0.56/mile

Mileage and Regular Commute

Commute: Travel between home and Official Workstation.

Official Workstation: The city or town where the employee works on a permanent basis for one year or more.

Commute expenses are the employee's personal responsibility.

Examples

An employee's Official Workstation is Western's Bellingham campus. The employee has a business meeting at the Port of Bellingham. Travel between campus and the Port office may be covered, but travel between the Port office and the employee's home would be considered their regular Commute and not reimbursable.

The traveler drives from their home in Ferndale to Bellingham Airport for a flight to a conference. The mileage is considered their regular Commute, and not reimbursable. This example is shown in the Concur Expense: Deduct Your Commute image above.

Enterprise & National Car Rental

- Before renting a car from Enterprise please review rental information & restrictions.

- Enterprise Rental Car Reservation Instructions

- Enterprise & National Price Sheet

- Print your Enterprise Rental Receipt

- Create an Enterprise Billing Number

- Washington State NASPO Agreement

- Enterprise Holdings NASPO Agreement

Hertz & Other Car Rentals

Shuttle and Charter Options

Bellair Airporter Shuttles

Phone: 360-543-9372

Beeline Charters

Phone: 206-632-5162

Email: info@beelinetours.com

Bellair Charters (large groups)

MTR Western

Email: courtneyt@mtrwestern.com